Insurance Audits in Dental Practices: What to Expect and How to Prepare

Did you know that roughly 1 in 3 dental practices faces an insurance audit each year? With many payers expecting at least 80% accuracy in claims, insurance audits are a critical part of ensuring your dental practice’s financial success. Rather than a hurdle, they’re an opportunity to refine billing processes and build patient trust.

In this blog, we’ll dive deeper into the essentials of dental insurance audits, why they matter, and actionable best practices to help dental practices excel in compliance and patient care.

What Is a Dental Insurance Audit?

A dental insurance audit is a type of medical audit that serves as a formal evaluation of a dental clinic’s billing practices and patient documentation, usually initiated by:

- Insurance providers, such as Medicare, Medicaid

- Private payers

- Government agencies

The primary objective of conducting this audit is to determine whether submitted claims are accurate, medically necessary, adequately supported by clinical records, and compliant with applicable regulations.

Why Are Insurance Audits Necessary?

Insurance audits in the dental landscape are more than just routine checks. They are vital to the health and credibility of any dental practice. When conducted properly, they offer protection, promote transparency, drive improvement, and help ensure that the services billed were performed and align with the payer’s coverage guidelines.

In 2021, over 37.5 million health records were compromised in more than 64,000 reported breaches, many of which resulted in fraud, theft, and significant disruptions to individuals’ access to care and credit.

This is just one of the potential effects of not auditing your clinic. By promoting accountability and transparency, audits help protect both dental providers and patients while supporting the integrity of the healthcare system.

Here’s why dental audits matter:

Confirming the accuracy of billing and coding

Identifying potential errors, overbilling, or fraudulent activity

Evaluating the quality of clinical documentation and patient care

Ensuring compliance with applicable state and federal laws

Help prevent billing scams and protect patients from medical identity theft

Common Types of Dental Insurance Audits

Dental clinics, along with medical practices, may encounter several types of audits, each aimed at ensuring accurate billing, proper documentation, and compliance with payer rules and regulations:

- Claims Audits. Verify that billed services align with documentation and comply with payer policies to help prevent denials and overpayments.

- Compliance Audits. Evaluate adherence to regulations like HIPAA, Medicare, and Medicaid, focusing on billing integrity and patient data protection.

- Coding Audits. Review CPT, ICD-10, or CDT codes to catch undercoding, overcoding, or other errors that can affect reimbursement or trigger penalties.

- Risk Adjustment Audits. Validate diagnosis coding and risk scores, especially in Medicare Advantage, to ensure fair and accurate reimbursement.

- Utilization Review Audits. Assess whether treatments were medically necessary and aligned with clinical guidelines and payer coverage terms.

These audits play a key role in protecting your practice from revenue loss, compliance risks, and potential legal issues.

What Happens If You Fail An Audit?

Failing an insurance audit can carry severe financial and operational consequences far beyond just a rejected claim. Practices that fall short of payer requirements may face:

- Denial or partial disallowance of specific claims

- Extrapolated repayment demands based on identified issues

- Removal or exclusion from insurance programs or provider networks

- In severe cases, disciplinary actions or legal consequences

To minimize these risks, dental practices must go beyond reactive fixes and adopt proactive, consistent practices that support audit readiness every day. The following best practices can help ensure your clinic is both compliant and resilient, before, during, and after an audit.

How to Prepare: Best Practices for Dental Clinics

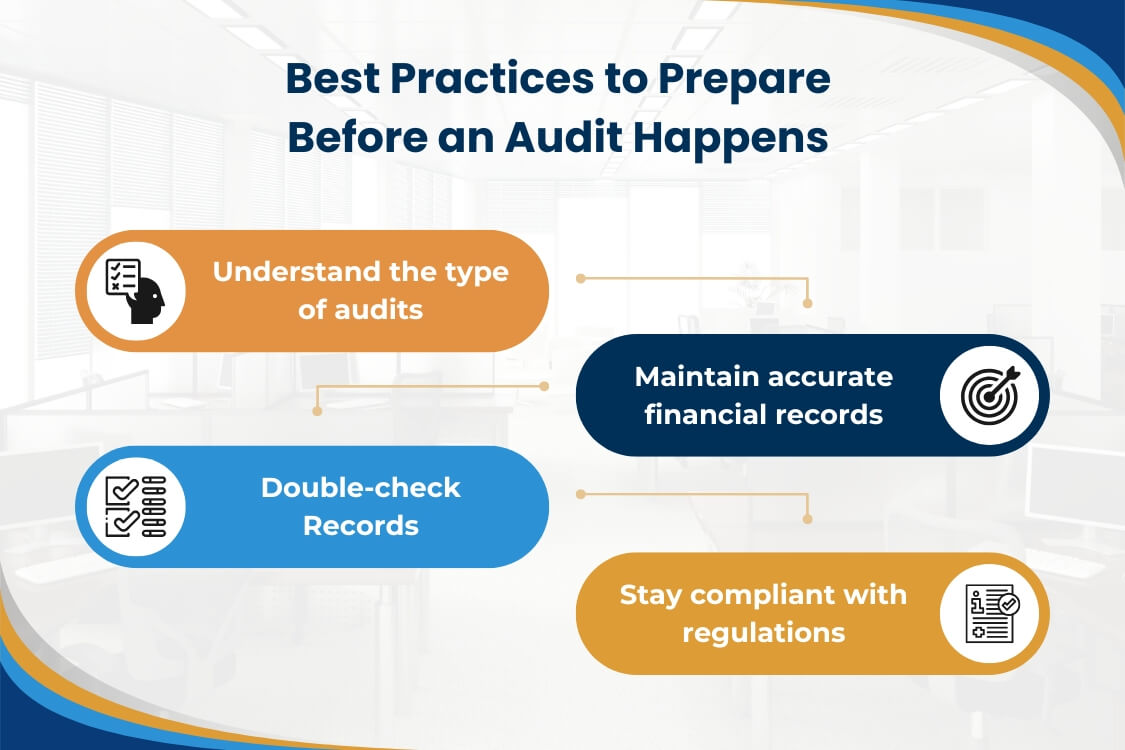

Preparation is key to passing an audit smoothly, and even turning it into a strategic advantage. Dental clinics that stay organized, updated, and proactive are far less likely to face billing issues, delays, or penalties.

Here are proven steps you can take:

1. Understand audit types.

- Learn the audits your practice may face, such as claims or coding audits

- Conduct internal reviews, as recommended by the American Dental Association (ADA), to monitor compliance.

- Prepare for external audits by insurers or third parties, which may include retrospective or focused reviews outlined by the American Academy of Professional Coders (AAPC).

2. Maintain accurate financial records.

- Organize billing data to meet audit requirements.

- Partner with revenue cycle management experts, such as Synapse Dental, to streamline financial tracking and ensure accuracy

3. Double-check coding.

- Use current Dental Terminology (CDT) codes accurately to avoid red flags, as recommended by the California Dental Association (CDA).

- Train staff regularly on coding standards based on ADA’s CDT Code guidelines.

4. Stay compliant with regulations.

- Stay updated on payer policies and billing regulations, such as those outlined by the Centers for Medicare & Medicaid Services (CMS).

- Ensure patient records include dates, provider signatures, and medical necessity rationale.

Consistent attention to these details not only prevents billing errors but also provides a strong defense during audits.

Be Prepared, Not Surprised: Stay Audit-Ready with Synapse Dental

Dental insurance audits don’t have to be stressful. With proactive workflows, accurate documentation, and trusted tools like Synapse Dental, your clinic can manage audits with confidence and ease.

Our comprehensive billing solution helps you stay on top of every detail that matters during an audit, while improving your day-to-day operations.

- Maintain audit-ready records through accurate claim documentation and tracking.

- Reduce administrative burden by outsourcing billing, eligibility checks, and follow-ups.

- Improve cash flow with faster claims processing and fewer billing errors.

- Increase collections through expert handling of denials and appeals.

- Minimize compliance risk with consistent processes and real-time oversight.

Being audit-ready isn’t just about avoiding penalties, as it’s a sign of a high-quality, trustworthy dental practice. With Synapse Dental, you’re not just outsourcing billing, you’re building long-term resilience.

Sources

Audits Utilization Review; Lifted from

https://www.ada.org/-/media/project/ada-organization/ada/ada-org/files/resources/practice/dental-insurance/ada_audits_utilization_review.pdf

Are you prepared to be audited by a dental benefit plan?; Lifted from

https://www.cda.org/newsroom/billing/are-you-prepared-to-be-audited-by-a-dental-benefit-plan/

Audits and Investigations: What You Need to Know; Lifted from

https://www.aapd.org/assets/1/7/Litchs_Law_Log1.PDF

Medical Auditing FAQs; Lifted from

https://www.aapc.com/resources/medical-auditing-frequently-asked-questions?srsltid=AfmBOorraIRCOa6Atdy0Wqjs3xVz96oMnme1r2ZIXSzM62rwdJpSExsL

American Dental Association (ADA); Lifted from https://www.ada.org/-/media/project/ada-organization/ada/ada-org/files/resources/practice/dental-insurance/ada_audits_utilization_review.pdf

American Academy of Professional Coders (AAPC); Lifted from

https://www.aapc.com/resources/medical-auditing-frequently-asked-questions

American Academy of Pediatric Dentistry (AAPD); Lifted from

https://www.aapd.org/assets/1/7/Litchs_Law_Log1.PDF

California Dental Association (CDA); Lifted from

https://www.cda.org/newsroom/billing/are-you-prepared-to-be-audited-by-a-dental-benefit-plan/

ADA CDT Code Guidelines; Lifted from

https://www.ada.org/publications/cdt

Centers for Medicare & Medicaid Services (CMS); Lifted from

https://www.cms.gov/medicare/payment/fee-for-service-providers

Contact Form

Get a FREE quote and AR analysis from us by filling up the info below.